Research Product Personas, build your ICP and wrap up your market research

Let’s dive into part 2 of our market research framework (find part one here). This post goes deep into understanding your customer, how to research who they are and how they buy, and what competitors they’re using now instead of your solution.

By the end of this guide, you’ll be able to build your Ideal Customer Profile (ICP) and define the buyer personas you want to target with your MVP or new feature update.

Here’s how we’ll get there:

- Identify persona groups for research

- Prepare the questions you’ll use

- Understand the competitive landscape

- Sum up your research findings

- Build your ICP + define your personas

Identify persona groups for research

To find insights about future users you can do primary and/or secondary user studies. During primary studies you get information right from the target audience through interviews, surveys, etc. While secondary studies provide insights from existing research and public information.

Start from identifying on a high level who your product serves. Let’s take for example the immigration platform VISXA that was launched out of the Paralect Accelerator last year.

The target audience is a person who wants to immigrate or relocate. If we look a little bit closer to the audience, you’ll find that people immigrate for different reasons, like education, marriage, work, etc.

So the buyer's persona will differ according to the reason for immigration, moving or relocation.

Here’s where you can find research participants:

- Customers who made a recent purchase of a similar product — find them via social media, app stores, questions in target communities.

- Customers who were actively evaluating a product but didn’t buy — find via forum discussions or other relevant communities.

- Customers who have used a product but stopped — find via open polls on social media or the same target communities as above.

Don’t forget to look at your problem from different perspectives, not just your own — even (especially) if you’re building a product that solves your pain point.

In the case of VISXA, there are the broad, international “digital nomad” communities along with location specific groups like “Foreigners in Croatia” where a lot of problem-specific discussion takes place.

While both are diverse in terms of origin, the digital nomad community would skew younger, more tech-savvy and may be more open to chatting travel or relocation tech.

Prepare your research questions

You have two obvious goals for your research interview. First, to get the primary qualitative and quantitative data to meet your key research objectives.

Second, but no less important, is to show respect for the participants and leave a lasting good impression.

Remember, this is (probably) your target market. So being organized, concise and clear with their time may be the first step to a long-time satisfied user down the road.

Some things to consider:

- Lean towards open-ended questions — simple yes/no questions have a place for understanding context, or should be followed with open questions.

- Set the context of the discussion with an opening series of questions.

- Then dig progressively deeper into specific problems. Try to get both qualitative and quantitative data along the way.

- Be friendly, have a natural conversation!

Here’s an example question flow from a product we were validating last year around the topic of workplace feedback.

Understand the competitive landscape

During your persona group research interviews or surveys, don’t miss the opportunity to find out what solutions they currently use. And what pain points they have with what’s on the market now.

Next, take these steps to understand what your competitors offer and how you can differentiate your product.

- Gather up who your competitors are and what products they offer. Include costs, the quality of their support, general product quality, etc.

- Look at the pricing breakdown — what features are included at what tier, fremium vs free trial and any other perks that their customers especially highlight.

- Understand their sales tactics. Go “mystery shopping” and go through the sales or onboarding process yourself.

- Assess their marketing and/or content strategies — see what format and types of content resonate on which channels. If they use Facebook ads platform, look through the ads library to see what ads are posted for a given region, time period and keyword.

- How do they promote their content and what’s their engagement like?

- What’s their tech stack? Why did they choose these technologies?

- Lay it all out in a SWOT Analysis to see how you can win customers in the space.

☝️ Remember, this doesn’t start on launch day (or the week before)! The team should know how and why they’re designing, building, and writing about the product that beats the competition."

This vision is supported by your market research and conveyed consistently across the team.

Summorize the findings

Where and how you gather the results is up to you and the team — it can be a slideshow, a Notion page, Figjam, Miro board. Whatever digital space your team prefers!

By now you might have a huge amount of data — the goal isn’t to present it ALL! Chances are eyes will glaze over and key points will be missed.

So, summorize and highlight. You can always share raw data with those who are really keen to know it all.

The summary should include:

- Context: Your research goals and why you conducted this study.

- People: What persona groups did you include? Break them down in a table by logical segments.

- Key findings: What were the most interesting things you learned? What can the team do with this information?

- Awareness: Share how and why the target market realizes their problem(s) exist and decide to explore solutions. Include quotes that describe the exact triggers.

- Consideration: How do they compare solutions? How long and how many options are in their consideration set, who’s advice do they seek out, etc.

- Decision: How is the purchase decision made? Who is involved (in many cases the buyer and end user are different)? What features or moments activate the purchase?

- What’s next: Give a range of ideas to get your product in front of this audience based on the findings. Better to prioritise them and include an estimated timeline!

Build your ICP + define your personas

To better understand the personality of your buyers, how they make decisions, their selection process and other aspects of their buyer journey, I recommend doing 2 exercises.

First — build an ideal customer profile (ICP)

Did you notice “ideal”? It means from the first moment you focus your attention on those who are more likely to buy, as they truly share the pain you kept in mind while developing the product.

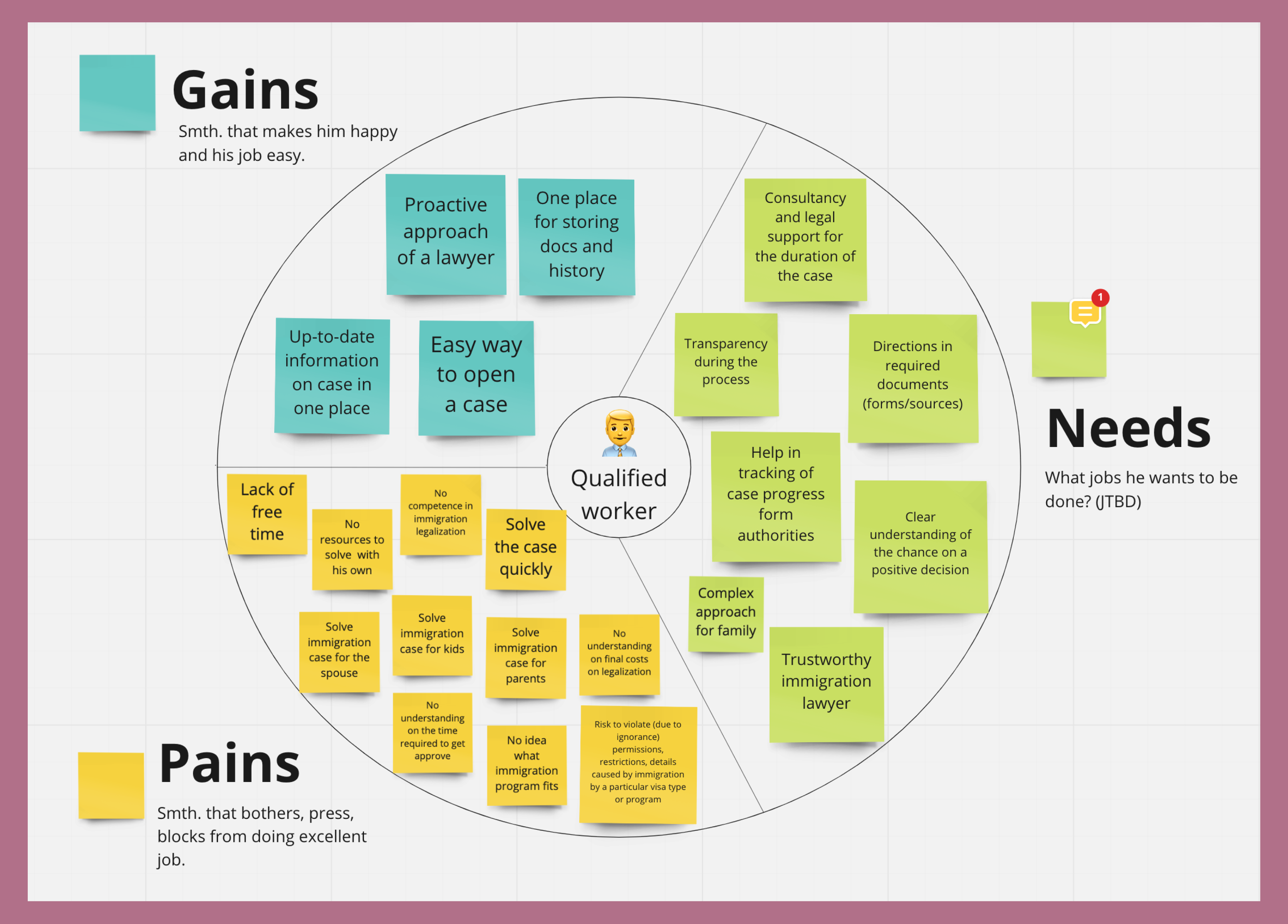

Here’s a simplified example of an ICP built for the immigration platform VISXA. People can find a lawyer, open an immigration case and solve it transparently, with expected price and timelines.

Include needs and gains into the map. Needs will show you how users want their problem to be solved. Gains mostly cover added values that users appreciate, but don’t treat as a central point while buying.

And, before building ICP, identify your audience on a high level (e.g. immigrants in case of VISXA) and then segment the audience. Only after that start building ICPs for each one separately.

That’s how you’ll build a specific enough, deep-seated and conscious portrait.

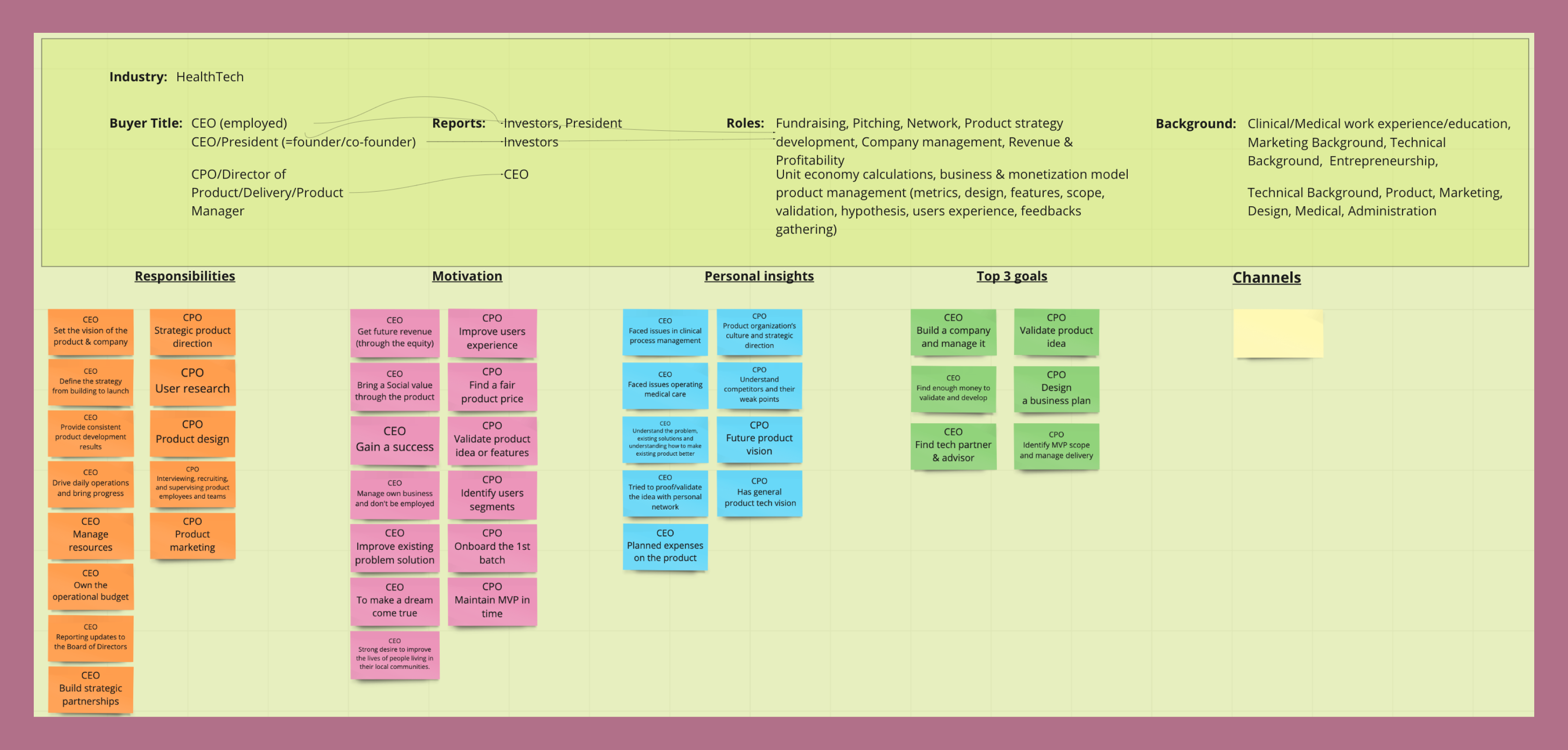

Second — define buyer personas

The buyer persona will help you to build a set of criterias to search for the right decision maker, while ICP will help to address actual pain points in your messaging.

Below is an example of buyer personas for a HealthTech product.

That’s it, a full roadmap for your product market research.

As part of our product discovery and design phase, market research is key to understanding who and why your idea fits best!